If you are a trader, chances are good you already heard the phrase “the trend is your friend.” Trend trading strategy is a popular prop trading strategy that aims to capture profits by following the prevailing market trend. For prop traders, it does not matter whether prices are going up or down. What matters is that there is a trend they can capitalize on with their funded trading account.

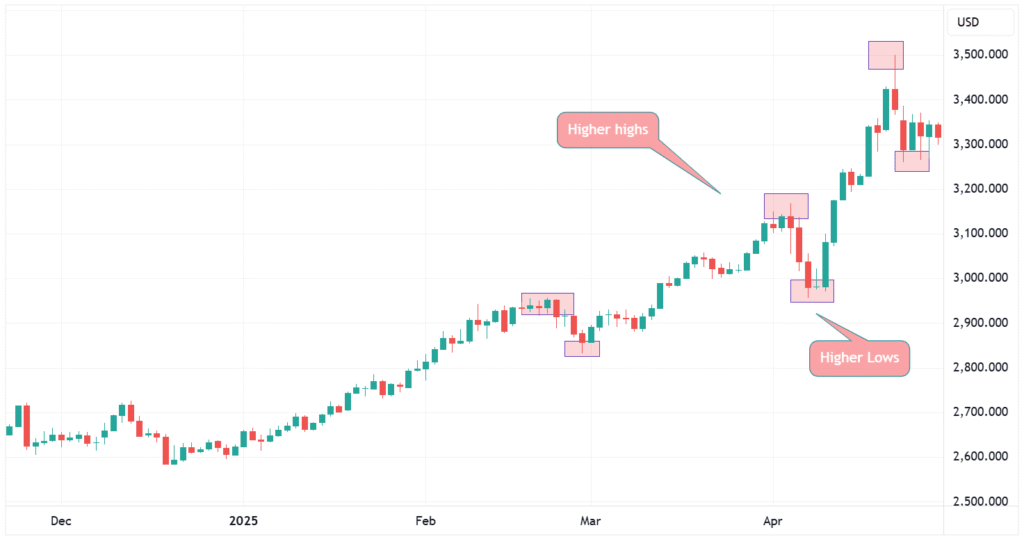

Before diving deeper, it is crucial to understand what a trend is. On a chart, this appears as higher highs and higher lows for an uptrend, or lower highs and lower lows for a downtrend.

While trend trading strategy may sound like long-term investing, that is not always the case. You can apply it on hourly charts and keep positions open for less than a day. The benefit is flexibility, because trend trading can be applied to forex, stocks, indices, or crypto, as long as there is a clear trend.

Another strength is that it can be combined with supporting tools like moving averages, Fibonacci retracements, and pivot points. That makes it one of the most adaptable trading strategies available to prop traders.

When trying to pass a prop trading challenge, there are strict rules about drawdown and profit targets. A trend trading strategy often produces a favorable risk-to-reward ratio, which makes sustainability easier.

Because trend setups typically require fewer trades, the risk of making repeated mistakes is reduced. Even if the win rate is modest, the potential size of winners often outweighs small losses.

For any prop trading strategy, consistency and discipline are key. Clear rules, from entry to management and exit, make trend trading attractive. It also fits well with forex prop trading and stock prop trading, as both asset classes generate strong trends during news events and market cycles.

Most traders use candlestick charts, checking whether markets show higher highs and lows (uptrend) or lower highs and lows (downtrend).

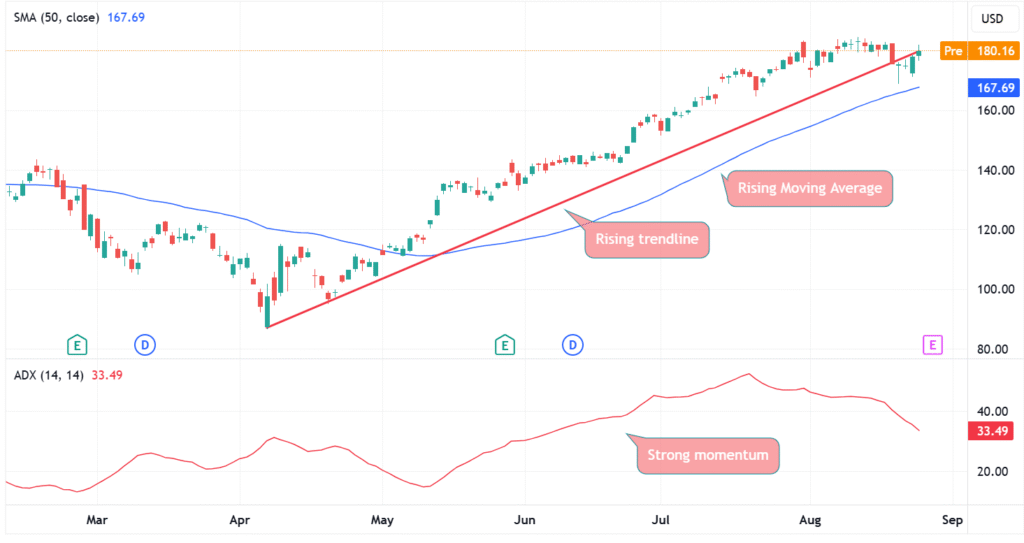

Trendlines are another tool, though drawing them can be subjective. Indicators such as moving averages or the ADX (average directional index) provide additional confirmation of the trend’s strength.

These tools help traders build confidence when applying a prop trading strategy in a live or funded trading account.

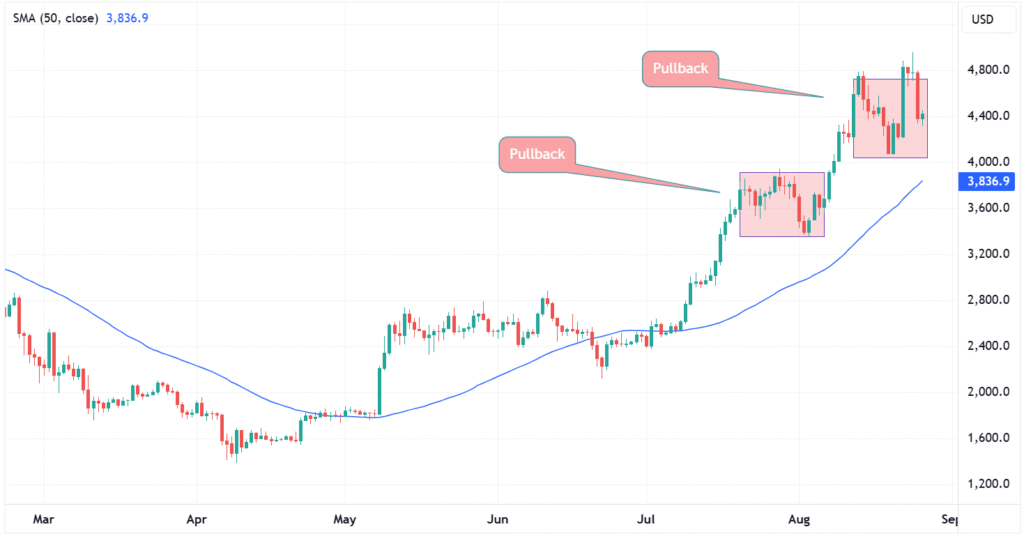

Trend traders want to capture as much of a move as possible. Popular approaches include breakout trading and pullback trading.

When the market consolidates, traders watch for price to break out in the direction of the trend.

Instead of waiting for consolidation to end, pullback traders enter when price temporarily moves against the trend. Entry can be at classic support and resistance levels, Fibonacci retracements, pivot points, or moving averages.

Because false signals are more common, risk management becomes essential. Stop losses must be tight, and profit targets clearly defined.

Risk management is crucial for anyone trading with a funded trading account. Prop firms set rules for maximum daily loss and overall drawdown, but traders should also apply their own limits.

By respecting these principles, traders protect themselves from disqualification while showing the consistency prop firms value.

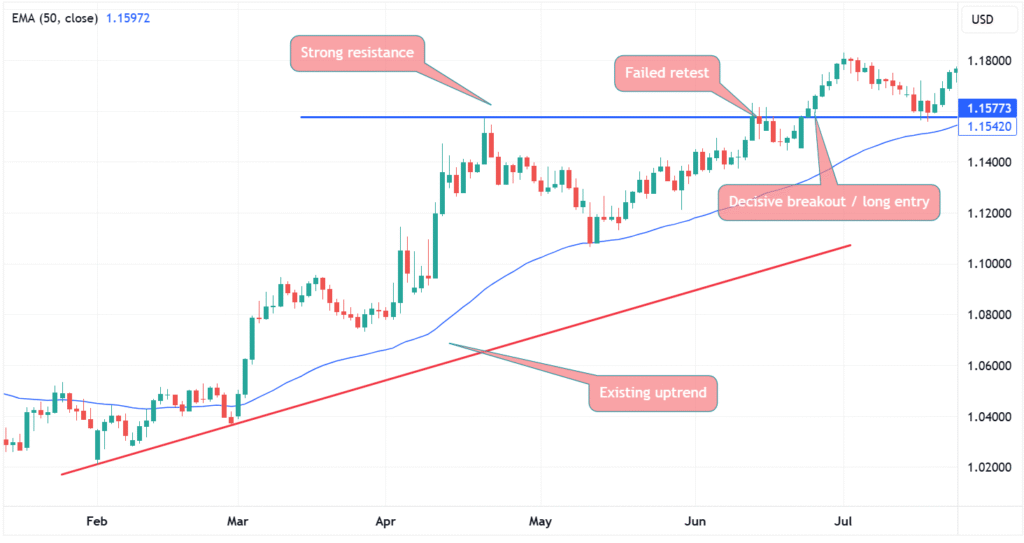

Consider EUR/USD in an uptrend, confirmed by higher highs, higher lows, and a rising 50 EMA. After testing strong resistance at 1.1577, price consolidates, then breaks out decisively. This breakout provides a long entry, with a stop just below 1.1577 and a profit target at the next resistance.

This setup demonstrates how trend trading strategies can be applied in forex prop trading, combining technical analysis with structured risk management.

Trend trading strategy is popular because it works across timeframes and markets. Whether trading currencies, equities, or crypto, strong trends appear regularly.

For traders using a funded trading account, trend trading offers:

Trend trading remains one of the most practical methods for prop traders. Breakout and pullback strategies can both deliver results when combined with strong risk management.

Above all, consistency and discipline are what make trend trading a valuable prop trading strategy. Apply it within the rules of your funded trading account, and it can be the difference between failing a prop challenge and trading with significant capital.