Momentum trading is a powerful trading strategy that focuses on capturing strong market movements. Instead of waiting for long-term trends to unfold, momentum traders aim to profit from fast-moving price action, buying rising assets with the expectation that they will continue to climb, or selling falling assets with the belief they will drop further.

This fast-paced approach is particularly well-suited to prop trading, where traders must operate within strict rules around drawdowns, profit targets, and time limits. A carefully designed prop trading strategy built on momentum trading principles can help traders stay within firm guidelines while still unlocking significant gains. For those working with a funded trading account, momentum trading allows for efficient use of leverage and tight stop-losses, ensuring that risk stays controlled while opportunities are maximized.

At its core, momentum trading follows the principle of “buy high and sell higher” or “sell low and buy back lower.” Instead of trying to catch exact tops or bottoms, traders ride the existing wave of price action.

This trading strategy can be applied to any market and timeframe, from forex prop trading on one-minute charts to stock prop trading on daily charts. What matters most is not the asset class but the strength and persistence of momentum.

Momentum traders thrive on clarity and speed. They look for conditions where price is moving decisively, and they avoid markets that are choppy or directionless. Here, trading psychology plays an important role - discipline is essential to cut losers quickly and not chase every single price movement. By sticking to high-probability setups, traders can avoid overtrading and maintain consistency.

Prop firms provide traders with access to capital but require adherence to strict rules. A funded trading account typically comes with:

A prop trading strategy that relies on long-term investing or holding trades for weeks would often clash with these requirements. Momentum trading, however, aligns perfectly with the prop firm model.

Because it targets short-term opportunities, momentum trading allows traders to capture gains without violating time constraints. The style also naturally supports tight stop-losses, which strengthens risk management and helps avoid breaching drawdown limits. Additionally, the ability to generate multiple trade opportunities within a session makes it easier to reach profit targets, provided traders maintain consistency in trading and avoid impulsive decisions.

In short, momentum trading provides the speed, flexibility, and control that prop trading environments demand.

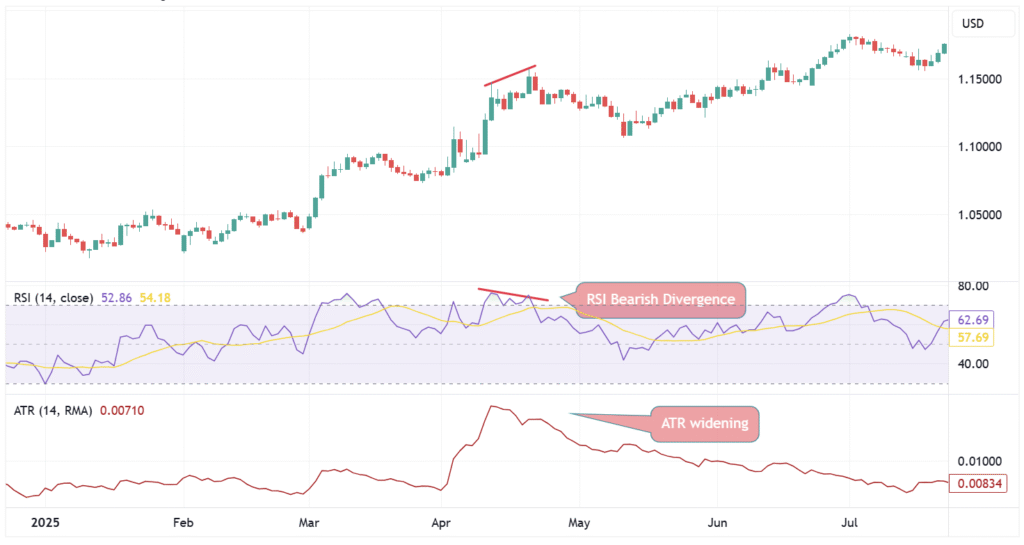

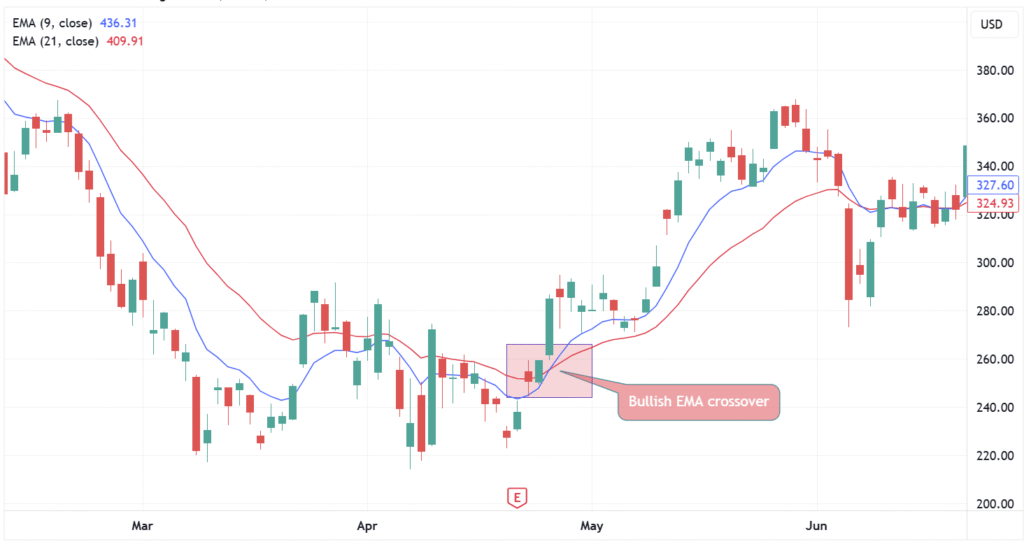

While some traders rely on pure price action, many incorporate indicators to refine their setups and improve trade accuracy. Several tools stand out when building a momentum-focused trading strategy:

By combining these tools, traders in stock prop trading and forex markets can filter out false signals and enter only when momentum has real strength.

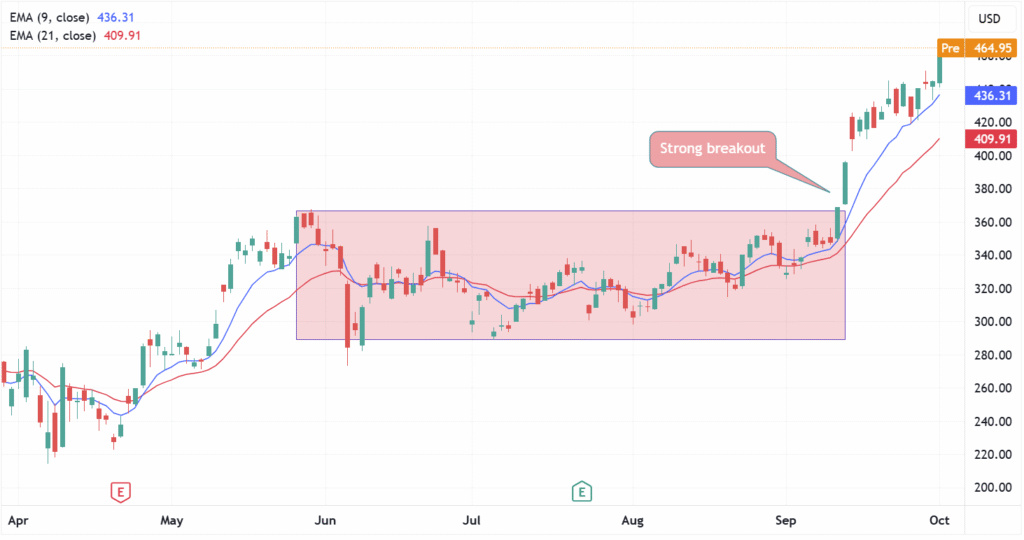

One of the most popular setups in momentum trading is the breakout strategy. This occurs when price consolidates before decisively breaking through a key support or resistance level. If the breakout is supported by volume and volatility, it signals strong continuation potential.

Another widely used approach is EMA crossovers. For example, when a short-term EMA crosses above a longer-term EMA, it suggests rising bullish momentum. However, since moving averages lag, traders often combine them with volatility measures like the ATR or momentum oscillators like the RSI.

These setups are especially useful in prop trading, where speed and clarity of execution are critical. For instance, in forex prop trading, a breakout during the London session can provide multiple short-term trade opportunities. Similarly, in futures or equities, high-volatility periods, such as after earnings releases or economic news, offer fertile ground for momentum setups.

By mastering trade selection and filtering signals effectively, traders can make the most of opportunities within a funded trading account.

No prop trading strategy can succeed without strong risk management. Momentum trading is advantageous here because it allows traders to use tight stop-loss orders.

For example, when trading a breakout, stops can be placed just below the resistance level (in a bullish breakout) or just above the support level (in a bearish breakout). If the price quickly reverses, the trade is exited with minimal loss. This precision is crucial in a funded trading account, where drawdown breaches can end a trader’s evaluation or live status.

Profit-taking requires equal discipline. Some traders target the next major support or resistance level, while others exit when momentum indicators show weakening strength. Incorporating elements of consistency in trading, such as using fixed risk-to-reward ratios, ensures that wins and losses are balanced in the long run.

In essence, momentum trading provides the tools needed to keep losses small while giving winners room to run, an ideal combination for the prop firm environment.

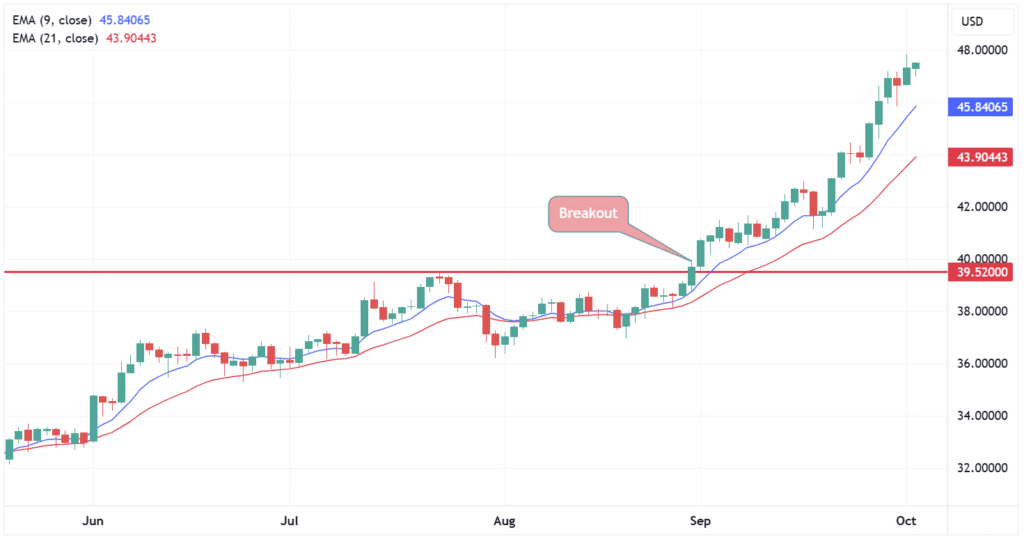

Consider a scenario in the silver market. The metal has been trending higher, with EMAs sloping upward and price consolidating under a resistance at $39.52.

A decisive breakout above this level signals renewed momentum. A trader applying a prop trading strategy would enter long at the breakout, place a tight stop just below $39.25, and target the next resistance level higher.

In this example, the prop trading trader benefits from:

Such setups can be replicated in both forex and equities, making momentum a versatile strategy for traders across markets.

Momentum trading is one of the most practical styles for traders working within a funded trading account. By focusing on fast-moving market conditions, it provides opportunities that align well with prop firm rules around drawdowns, time constraints, and profit targets.

When applied as a disciplined prop trading strategy, momentum trading combines tight risk management with the potential for significant upside. The key is to maintain consistency in trading, avoid overtrading, and use technical tools to filter out false signals.

For traders serious about success in prop trading, mastering momentum trading could be the difference between passing an evaluation and building a sustainable long-term career.