Range trading is a trading strategy that involves profiting off markets that are moving sideways. We often hear the phrase "the trend is your friend", and it is true that trends can involve rapid price movements from which traders can capitalize from. However, markets that move sideways can also generate plenty of trading opportunities and may suit certain types of traders better.

Range trading essentially consists of buying an asset near the bottom of the range (key support), in anticipation that it will bounce off once again and move towards the upper range. On the other hand, we would sell the asset once it is close to the top of the range, anticipating that it will be rejected at the key resistance level and head towards the lower part of the range.

Prop traders need to achieve their profit targets, but at the same time adhere to drawdown limits and risk management rules, as well as facing time limits (evaluation period). Range trading can be a suitable strategy as it is about catching smaller, high probability moves within a predefined range rather than looking for an explosive move or the next big trend.

A major advantage of range trading strategies is that it typically allows for tight stop loss orders. If price has broken out below support or above resistance, the range is broken, and there is no point in continuing the trade. Thus, traders will place the stop loss order just below the key support or just above the key resistance level.

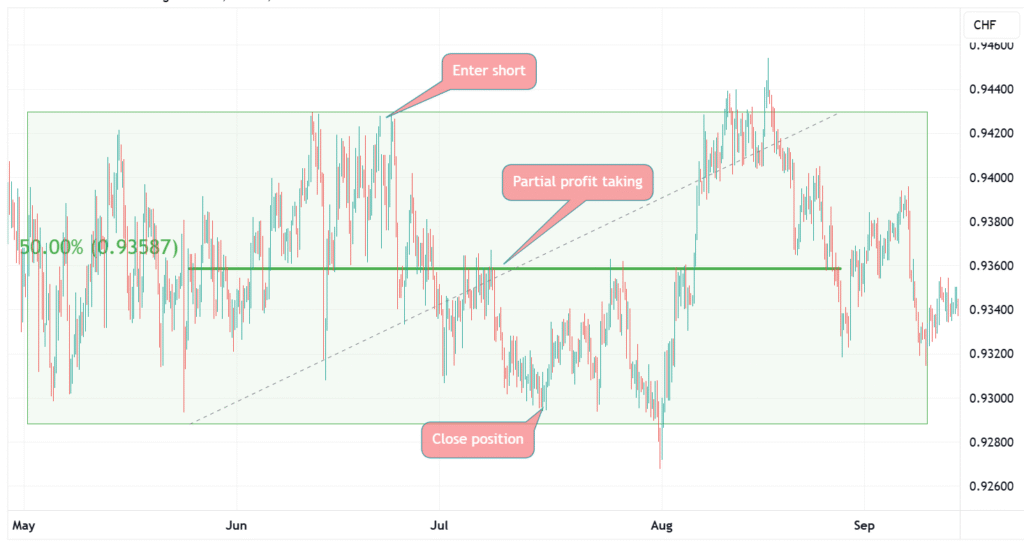

Another reason range trading can work well for prop traders is that markets consolidate actually quite often. Even during strong trends, there are usually frequent periods of consolidation that range traders can exploit. There are also specific assets that are more suitable for range trading and have lower volatility. In the world of FX, EUR/CHF is a popular currency pair for range traders as it is (aside from the occasional spike) often moving sideways.

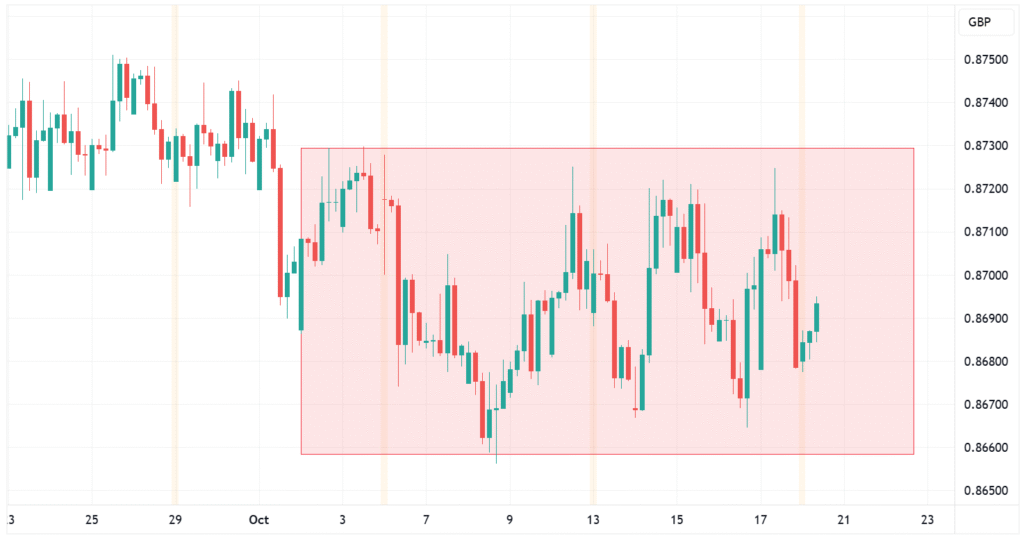

A trading range is an area on the chart where price has been moving between a resistance and a support level without forming new higher highs or lower lows. It is easy to identify on the chart and looks like this:

Once you have identified a range, draw the support line connecting the lows and draw the resistance line connecting the highs. Some traders also mark 50 % of the range, which typically adds as an additional support or resistance level.

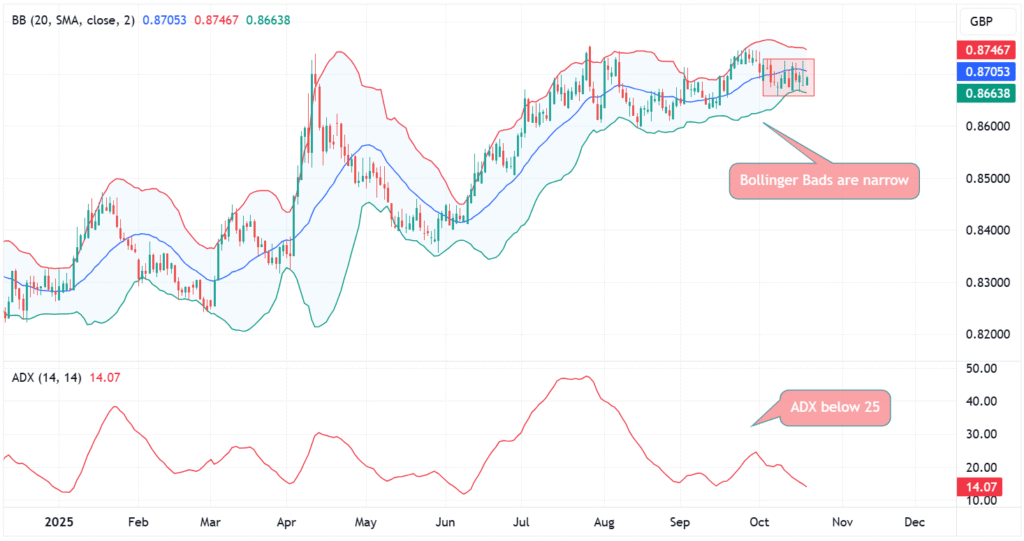

While the above described steps are often enough to establish that there is a range, traders also make use of technical indicators to confirm it. Popular indicators include:

When trading the range, we expect price to continue to move within the range. This means, we are looking to buy the asset at the support level (bottom of the range) and sell it at the resistance level (top of the range).

While the idea behind it is simple, the entry can be a subjective matter. Let's see the different methods traders can use:

The take profit order would be placed at the opposite end of the range. For example, if we enter a short position near the top of the range, we would place the take profit order just ahead of the bottom of the range. On the other hand, if we entered a long position near the bottom of the range, we would place our take profit order just ahead of the resistance level (top of the range).

EUR/CHF has been trading within a well-defined range. In the example below, we spotted an opportunity where the currency pair is once again at the top of the range and we would enter a short position at 0.9420 with a stop loss at 0.9450. A more conservative approach would be to take partial profits at 50 % of the range, while a more aggressive approach would be to wait for another sell-off towards the bottom of the range.

Range trading can work well for prop traders as it offers frequent trading opportunities and there are asset classes or instruments that are particularly suitable for this type of strategies. Range trading strategies often allow for a tight stop loss order, which is suitable for prop traders who need to adhere to drawdown rules.

That being said, range trading strategies have their limits. For example, breakouts can occur at any time and lead to losses, particularly during news events. Compared to trend trading, the profit potential can be limited as traders are not benefiting from the rapid price movements we can see during trends.